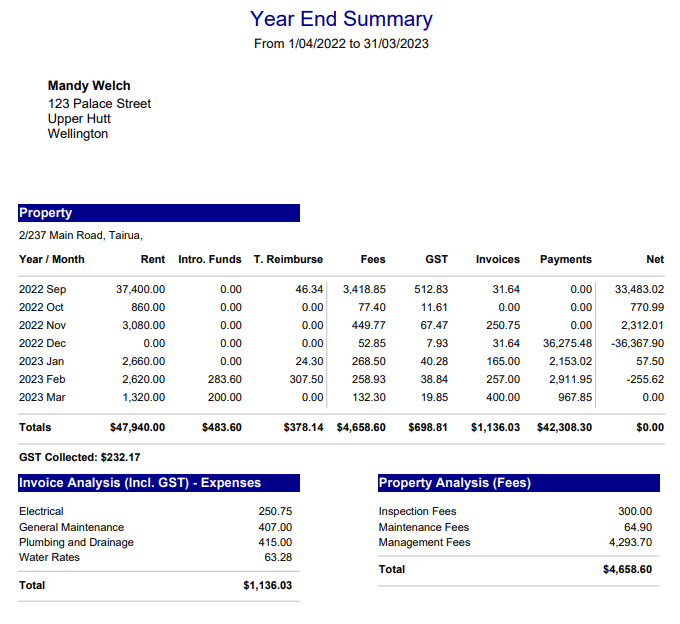

If the owner has more than one property, you have the choice of running one page for each property or a Summary, which collects the data from all the owner's properties and puts into one statement.

Each column is explained below:

Year/Month: Each month by year in the date range you have selected

Rent: The amount of money received in through receipting as Rent

Intro.Funds: This is any money that was receipted in that was not rent, i.e money paid to you by the Owner. None of the money in this area has been subjected to management fees. This is for all money that has been receipted in using the Receipt Owner transaction.

T.Reimburse: This is any money that was receipted in that was not rent but still paid by the tenant, i.e water rates, tenant invoices. Like the Intro Funds, none of the money in this area has been subjected to management fees (Unless you do charge a fee on a tenant receipt invoice). This is for all money that has been receipted in using the Receipt Tenancy Invoice transaction.

Fees: This covers the management, maintenance, inspections and admin fees

GST: The GST component of the Fees

Invoices: This is any Creditor Invoice or Payment Expense that has come from the property

Payments: Any Owner Payments made. This does not necessarily mean the owner got the money, it just means that a Transaction was done using Payment Owner

Net: This column is the total of the whole line. For instance line 1 says that it was overpaid for the month of April. This usually means that there was an opening balance in the month before. You take the rent amount and add any intro funds, then you minus the fees, GST, Invoices and Payments, the total is the Net amount.

Invoice Analysis (incl.GST) – Expenses: Every invoice that went against this property during the selected date range will be broken down into an expense type. This is the expense type that was selected against the Creditor

Note: If an expense type looks incorrect, or you wish to show a more specific expense type, you can retrospectively alter the expense type on any individual transaction by locating it in the History area of Transactions, and editing the transaction. The YTD Summary will then show the expense under the new expense type.

Missing Months: If a month is missing, this usually means that that month was closed using a close-off date in the subsequent month. (The subsequent month might then show figures for both months)."

Source:

The above article was written by Mandy Welch of MRI Palace on 6 April 2023.

RSS Feed

RSS Feed